Peer to Peer (P2P) is a financial innovation bringing lenders & retail borrowers together on the same platform with a direct relationship. P2P provides a marketplace for credible borrowers and investors looking for relatively higher return investment options. P2P in India Is Reserve Bank of India (RBI) approved & well-regulated and is a large alternative investment opportunity globally.

Our partner, IndiaMoneyMart is a Reserve Bank of India registered NBFC-P2P, providing competitive returns on investment with reinvestment options. If you’re an investor seeking better returns on your saving as compared to what a debt mutual fund or fixed deposit can give, you can become a P2P lender and potentially get higher returns!

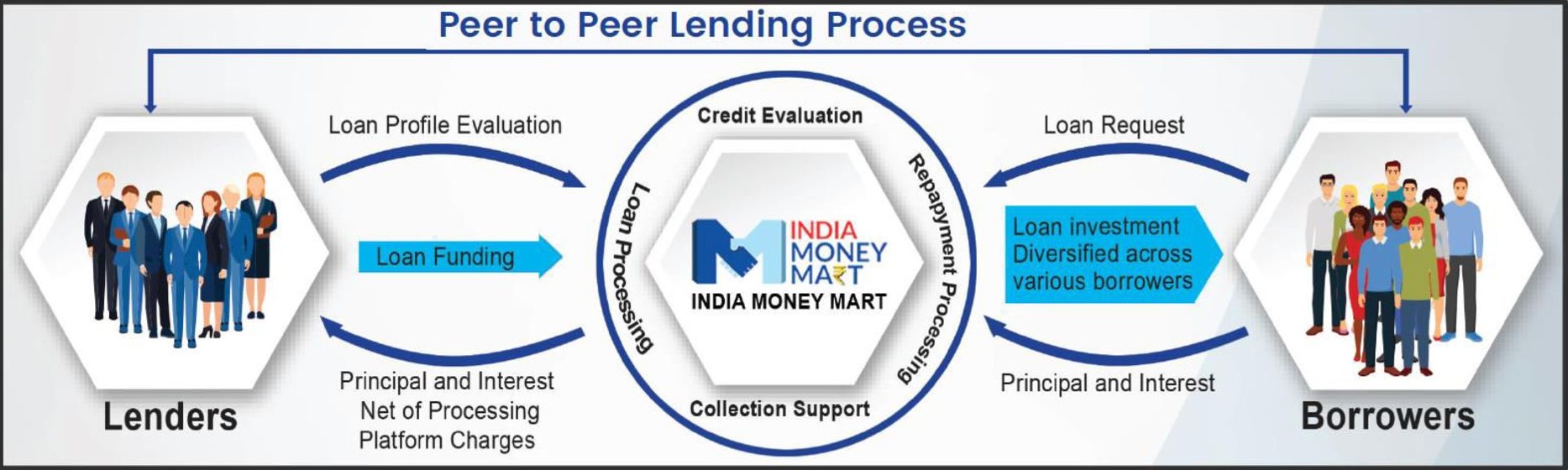

Here is a quick diagram to illustrate how the funds move from the lender to the borrower and the role of our partner IndiaMoneyMart in the entire process.

At Epsilon, we believe that we should let you dream – leave the tension of how you will plan finance for those dreams to us. We are here to help you and guide you, every step of the way. By always doing the right thing. By gauging your risk profile, investment horizon and recommending products accordingly. By doing what is best for you to achieve your goals.

Get in TouchUnit No. 101, 1st Floor, Simba Towers, CTS no. 67-A/1, Goregaon, Mumbai - 400063

ARN- 243441

Epsilon CIN No: U67190MH2022PTC377576

MultiArk CIN No: U67100MH2022PTC377409

IRDAI Registration Number: CA0866

Corporate Agent (Composite)