Blog |

The term, ‘Achilles Heel’, is used to describe a vulnerable point or a key weakness in another wise strong constitution. For investors, this vulnerable point is their ears metaphorically speaking. All investment ideas and plans are vulnerable to investment noise. We live in such fast-paced world, that we are continuously bombarded with data & information, most often unimportant. Noise is to an investor what kryptonite is to Superman! It drains their intellect and makes them vulnerable from taking the right decisions. And this is exactly why, we as investors need to practice ignoring much of the irrelevant information and opinions not founded on intensive research. For a good investor, the focus should be on:

1. Long term instead of short term.

2. Change in value instead of change in price.

3. Understanding an event and its implications instead of just knowledge of its occurrence.

In pursuit of the information edge, if investors fail to make this distinction between the signal and the noise, they become susceptible to behavioural mistakes. An excellent way of making the distinction between signal and noise is found in the book, “Before Happiness,” by Shawn Achor. The author lists four criteria of noise that are meaningless or distracting and that lead to errors in judgment:

- Unusable: The information will not lead to any change in your behaviour and action. Once we have defined our circle of competence and an area of focus, a lot of information outside of this is unusable. It just takes away a lot of our time and discussions about these data points do not lead to any better decision-making.

- Untimely: We are not going to use the information imminently and it could change by the time we use it. For a long-term investor, the constant in-depth analysis of a minute-to-minute change is just noise. It will just induce trading which will most often lead to suboptimal results.

- Hypothetical: It is based on what someone believes “could be” instead of “what is”. A lot of people bombard you with their opinions disguised or presented as facts. All of it is just disturbance.

- Distracting: It distracts you from your goals. Any information or discussion that distracts you from your investment goals should be ignored.

Using the above four filters will help an investor avoid impulse reactions, save more time for productive effort, and identify signals that benefit investment decisions. Noise can have a substantial negative impact on individual investment decision-making. Our mind can get anchored on the most irrelevant information and yet drive the next investment based on that. Therefore, one must consciously create screens to filter the signal from the noise.

In a world obsessed with instant gratification, the greatest investment advantage lies in patience. High-quality, “boring” stocks are persistently undervalued and offer superior returns over time, challenging conventional wisdom. This was famously encapsulated by Charlie Munger, who said, “The big money is not in the buying or selling, but in the waiting.”

Now patience doesn’t mean just Buy and forget it. Because that would ignore Risk Management. Let’s us take example of agriculture to understand better. In a farmland, the farmer must prepare the ground, put in the seed, cultivate, weed, and water if he expects to reap a harvest. Farming demands different things in the season according to natural cycles. And there is no way to fake the harvest. Similarly, in investing –

- Preparing the soil = Research on an investment idea and initial due diligence

- Sowing the seeds = Buying the stock

- Irrigation= Maintain due diligence of businesses, management, and valuation

- Harvesting= Sell the stock and keep the cash ready for re-investment opportunities

You cannot sow something today and reap tomorrow. It takes a while before a seed turns into a fully grown tree and starts bearing fruit. You water the ground daily but may see no result for a long time. But eventually, your effort pays off. As long-term investors, we are good at the first two steps. We generally tend to fail at 3rd and 4th. That is because we conflate buy-and-hold with buy-and-forget. Yes, we must be patient. But we must never take our eye off the ball. You can hold on to your stocks for years on end with the hope that they will generate a good return on the initial investment. But you cannot take that for granted. Not all seeds in the stock market can be watered until the time of harvest. Some stocks need to be moved out of the portfolio even before the harvest.

But why optimism? Afterall if we have cut the noise & remain patient enough, success is surely to be found? Not necessarily. We human are mortals, the decisions we make are influenced by our surroundings. And often, there is always a reason to not invest but stay in the side lines. Pessimism is easy and pervasive. It’s easy to make lists of problems and everything that could go wrong. The media often amplifies these fears, generating headlines that drown out positive developments.

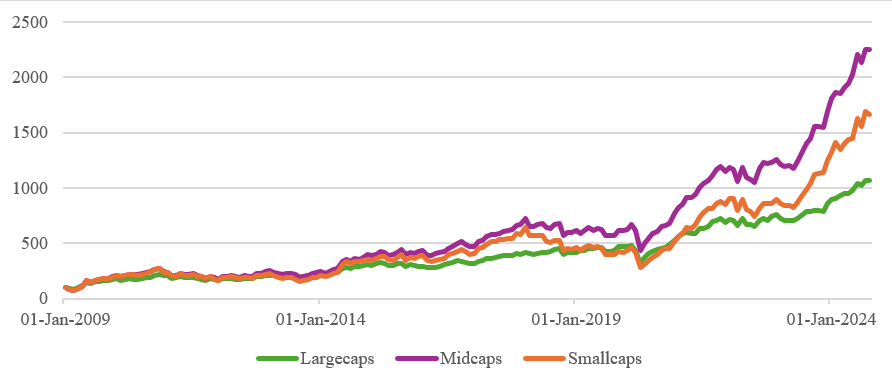

The legendary investor J.P. Morgan once met his friend in Chicago – someone who no matter what the market did, his outcome was always pessimistic, someone whom safely call a ‘Perma Bear’. During the lunch, Morgan’s friend was admiring the towering skyscrapers that were starting to define the Manhattan skyline. Impressed, he acknowledged they had nothing like them in Chicago. Morgan stopped, turned to his friend. “Funny thing about these skyscrapers,” he said,“ Not a single one was built by a bear!” This mindset of seeing opportunities where others see risks is crucial for long-term investing success. Fast forward to the Great Financial Crisis of 2008-2009, or the COVID-19 fall, where a similar dichotomy played out, anyone who dared or was even slightly optimistic with his back on the wall, would have been able to amas wealth of a lifetime; Nifty500 – TRI index alone is up ~3.7x since April 2020 and up ~10.6x since Jan 2009.Since 1st Jan 2009, Large caps are up ~10.7x, Midcaps are up ~22.5x and Small caps are up ~16.6x. This demonstrates that optimism can lead to substantial gains.

Today, we face similar challenges and opportunities. There are concerns about economic downturns, political instability, global conflicts and most importantly valuations. Earnings expectations are under pressure, and the 2024 US presidential election adds uncertainty. Yet, history shows that cutting the noise, staying patient and showing optimism often prevail. The optimists are eventually proven right. Not every day, but always and eventually. Despite the challenges and uncertainties, we face today, the long-term trend toward progress, convenience, and better living standards continues.

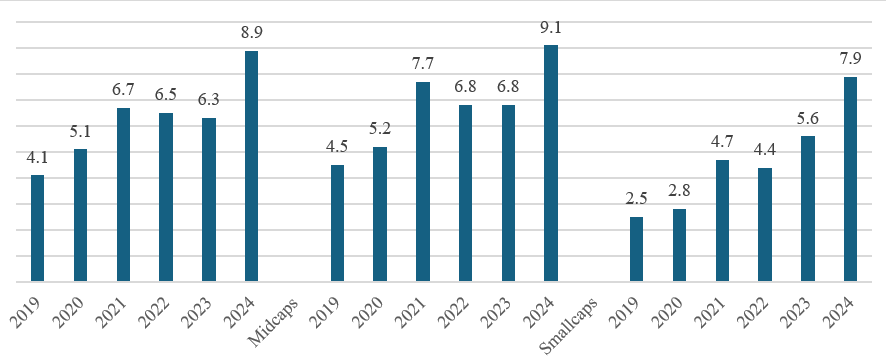

Yes, valuations remain stretched, especially in the SMID space. Over the last 5-years we have witnessed shallow corrections taking both P/E & P/B multiples at dangerous levels. Therefore, investors must tone down their return expectations moving forward. Also, a point to ponder in the current scenario is which asset class can generate positive post-tax real returns. If the money is to be invested for long term, parking it is Fixed Deposits might not be a great idea. For new investors, easy money is off the table and recovery might be slow and patience will be tested. Therefore, having the personalized suitable asset mix is paramount. Also, if struck in a company that is not reporting positive cash flows and investment thesis was more of a narrative owing to government initiatives, increasing order book, announced capex, etc. taking corrective actions will be more prudent.

In conclusion, the key to successful investing lies in knowing what you’re entering into & having a ready exit plan. By focusing on long-term gains, investing in high-quality companies, and maintaining a positive outlook, investors can navigate market volatility and achieve substantial returns. The stories of J.P. Morgan and Sam Zell illustrate the power of optimism and foresight, even during periods of economic uncertainty. As we face the challenges of today’s market, let us remember the lessons of the past and embrace the trinity of ignoring noise, exercising patience and remaining optimistic in our investment strategies.

By-

Siddharth Alok

AVP- Investments