Blog |

In the vast expanse of the financial universe, where stars twinkle with the promise of wealth and galaxies hold the secrets of prosperity, there exists a journey unlike any other – a journey into the heart of investing. As we navigate the labyrinthine corridors of the investment world, we encounter three enigmatic figures, each holding a key to the elusive treasure known as alpha.

The Information Edge beckons us with promises of hidden truths and untold riches, urging us to delve deep into the wellspring of data that flows through the markets. Armed with drones and satellites, we scour the digital landscape in search of nuggets of insight amidst the cacophony of noise. Yet, in our quest for superior information, we find ourselves ensnared in the web of information overload, where the signal is drowned out by the relentless roar of the market.

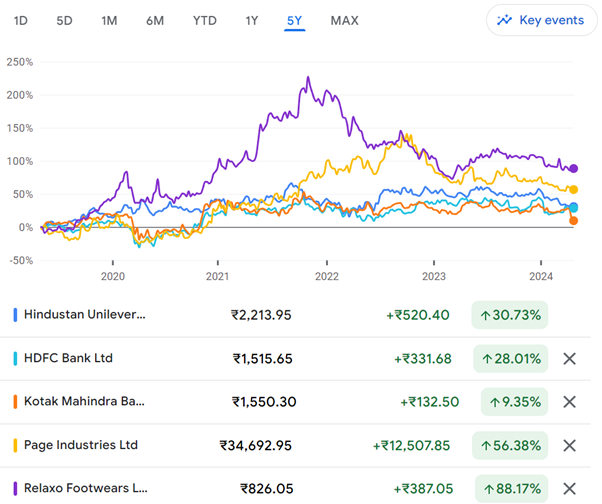

Undeterred, we press onward, guided by The Analytical Edge, a master of algorithms and models who wields the power of predictive analytics with surgical precision. In the realm of quantitative finance, we harness the tools of mathematics and statistics to divine the future with uncanny accuracy. Yet, even as we revel in the beauty of our models and the elegance of our algorithms, we are reminded of the ephemeral nature of certainty in the markets. For in the ever-changing landscape of finance, even the most sophisticated models can falter in the face of uncertainty, leaving us adrift in a sea of doubt. For example, look at the performance of some the quality companies in the last 5 years. There’s nothing wrong with the businesses, only excess price paid in the past led to unexpected outcomes. A simple index fund would have generated better returns. Nifty 50 has given a return of ~100% in the last 5-years, cumulating a CAGR of ~14.83%.

But it is The Behavioral Edge that truly captivates our imagination, a realm where human psychology reigns supreme. Here, we confront the myriad biases and heuristics that shape our decisions, navigating the treacherous waters of investor sentiment with steely resolve. From over reaction to underreaction, our minds play tricks on us, distorting our perception of reality and clouding our judgment. Yet, amidst the chaos, we find solace in the knowledge that awareness is the first step towards mastery, and that by understanding our biases, we can turn them to our advantage.

As we ponder the mysteries of the market, we are confronted with the concept of risk – a spectre that looms large over every investment decision. Volatility, the traditional measure of risk, however, fails to capture the true essence of uncertainty in the markets. For risk extends beyond mere price fluctuations, encompassing the very real threat of permanent loss and underperformance. Looking at seasoned investors, they consider risk as:

- The risk of losing capital permanently.

- The risk of underperforming against a target or benchmark.

Amid this uncertainty, we encounter Benjamin Graham’s allegorical figure, “Mr. Market,” a whimsical character whose daily gyrations offer both opportunity and peril. Like a capricious deity, Mr. Market tempts us with tantalizing offers one moment and strikes fear into our hearts the next. Yet, amidst the chaos, astute investors recognize volatility as a friend, not a foe—a beacon of opportunity amidst the storm. Armed with this newfound wisdom, we turn our attention to the art of portfolio management, where discipline reigns supreme.

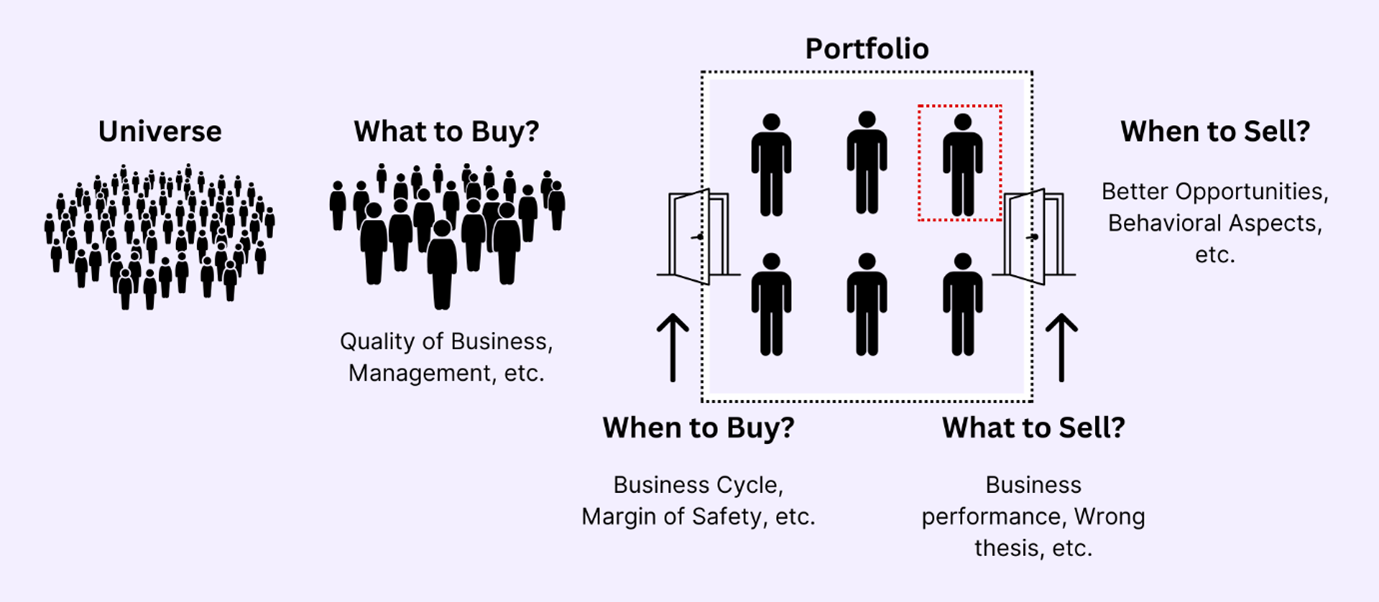

Imagine your portfolio as a room with two doors: the entrance and the exit. Picture two guards at each door. Let’s call them Nivesh (meaning investment) at the entrance and Vinivesh (meaning disinvestment) at the exit. Can both antonyms work together? Let’s, check.

Nivesh, the guard at the entrance, has a crucial job. His role is to carefully select which investments get in. He needs to be smart and disciplined. Nivesh has two big decisions to make: what to buy and when to buy. He scouts the market for ideas that match the investment philosophy, looking for companies with strong business models and good management. But figuring out the right time to invest is tricky. Some companies might seem too risky, while others might be too expensive. Nivesh’s goal is to create a VIP queue of promising investments waiting to get in. When should a promising company be available at a reasonable price? There are a few reasons:

- Sometimes, investors only focus on short-term gains, ignoring good companies facing temporary challenges.

- Market reactions to bad news can make a company’s stock price drop unfairly.

- Conversely, the market might under estimate a company’s long-term potential.

Deciding when to let a company into your portfolio involves both fundamental and behavioral factors. Nivesh can run into trouble if he ignores his discipline and lets in investments that don’t meet the criteria. This might happen because of:

- FOMO: Fear of missing out leads investors to make hasty decisions during a bull market.

- Rushing due diligence: Investors might skip proper research after hearing positive comments from company executives.

- Overpaying: Just because a company is good doesn’t mean it’s worth any price.

Vinivesh, the guard at the exit, has an equally important job, even though he’s often overlooked. In a fast-paced market, holding onto investments forever might not be the best strategy. Vinivesh monitors the investments already in the portfolio. If an investment becomes too large, reaches a target price, or its fundamentals change, it might be time to sell. Mistakes Vinivesh can make include holding onto losing investments too long or selling winners too early. These mistakes often stem from psychological biases like fear of losses or justifying holding onto a losing investment. Balancing both their roles can lead to a robust portfolio and better expected returns. Together, they form an indomitable duo, navigating the complexities of the market with grace and precision. Through trial and tribulation, they guide us on our quest for alpha, illuminating the path to financial success with each passing day.

And so, dear readers, as we venture forth into the wild frontier of finance, let us heed the lessons of the past and embrace the challenges of the future. For in the crucible of uncertainty lies the promise of untold riches, awaiting those bold enough to seize the moment and chart their own course to prosperity.

By-

Siddharth Alok

AVP & Investment Councilor