Blog |

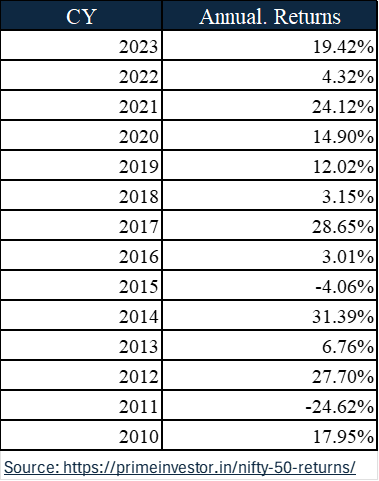

Last week I was reading a very old article by Dr. Sanjay Bakshi titled “Can Small Investors win?”. For those who do not know him, he is a renowned figure in the world of Value Investing, widely regarded as one of the pioneers of this investment philosophy in India. In the article, he was lamenting about the performance of the stock markets and how the morale of Indian investors was at a very low ebb as Sensex had fallen ~35% since September 1994. While periodic rise and falls are a norm of the markets and they generally move like sea waves, what caught my eye was he talked about the institutionalisation of the Indian stock markets, especially the Foreign Institutional Investors (FIIs) and that people believe small investors have no chance at all competing with big money. Well, how times change. We are not only currently quoting at All-Time-Highs but also it is the small investors who through their disciplined mode of investing have not let market close negative in the last 8 calendar years, with last major red last seen back in 2011. A look at the performance of Nifty 50 – TRI since 2010:

Well, maybe then the institutionalisation of the Indian stock markets is good after all? Also, rational small investor if able to exploit abundant opportunities properly, may outperform the experts?

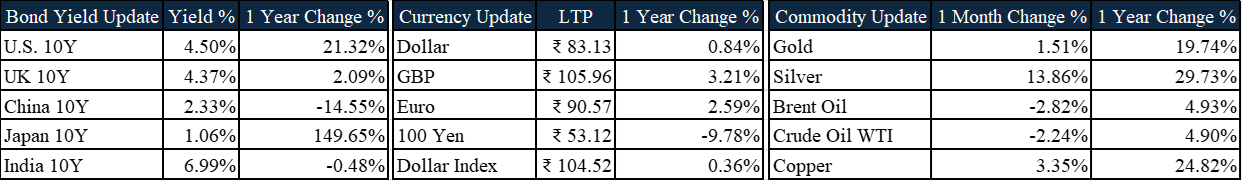

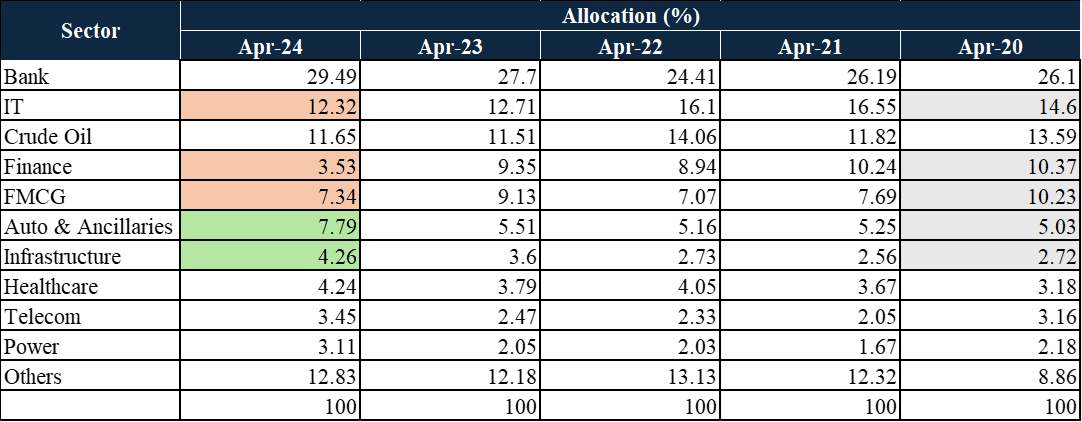

Before we delve deep for answers, there’s an important point to make – these days we hear a lot about how foreign investors are continuously taking out money from domestic markets. However, data shows a different picture altogether, FPIs/FII shave brought in big whenever opportunities galore and while their holdings in the Indian companies have come down, they still hold a sizable sum, and they are not going anywhere given the prospects India is offering.

Peter Lynch was once quoted – “I have been hearing that the small investor has no chance in this dangerous environment where there are 50,000 professional stock pickers who dominate the show, and the small investor ought to get out. From where I sit, I’d say that the 50,000 stock pickers are usually right, but only for the last 20 percent of a typical stock move. It’s that last 20 percent that Wall Street studies for, clamours for, and then lines up for – all the while with a sharp eye on the exits. The idea is to make a quick gain and then stampede out the door. Small investors don’t have to fight this mob. They can calmly walk in the entrance when there’s a crowd at the exit and walk out the exit when there’s a crowd at the entrance.”

But how can retail, who has limited access to information win? A few starting steps:

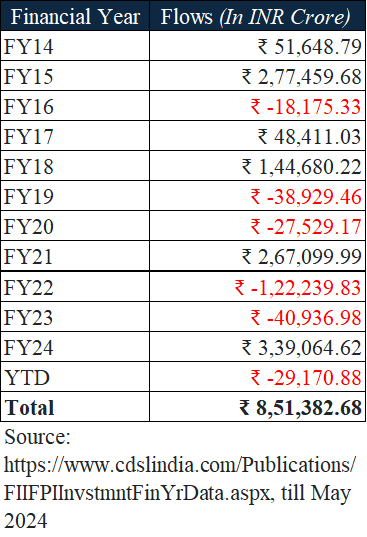

- They don’t need to follow any set rules – Institutions and funds generally must follow a lot of in-house mandates, policies, and regulatory requirements. For example: Some funds are restricted with a market capitalisation rule – they can’t own a stock in any company below, say, a Rs 1,000 crore market capitalisation. Let’s assume there’s a company which has a MCap of ~ INR 400 crore, the same company’s stock price becomes 3x in a year and suddenly it’s suitable for purchase. Thus, funds are allowed to buy shares in companies only when the shares may no longer be a bargain. Investors also need not look at the index constituents which change and rebalance every 6-months. A look at the changing sectoral weights in the last 5-years shows performing sectors gaining weightage, while laggards seeing outflows:

Source: AceMF Nxt as on April’24

Source: AceMF Nxt as on April’24 - While debatable, Smaller the size Better the chances of superior investment results –On absolute terms basis, large funds struggle to find enough profitable investments to match their size. A small investor needs far less capital to achieve similar returns, allowing them to capitalize on smaller, more numerous opportunities in the market. Of course, this does not mean that one should start investing in the stock markets with only ~INR 10,000. Such tiny sums will not enable the small investor to achieve meaningful diversification. Nevertheless, the fact is that the large size of the biggest of the mutual funds acts as a drag on their investment performance.

- Small investors do not have any competition nor the pressure to perform – Institutional portfolio managers are subject to scrutiny on everyday basis as daily Net Asset Values (NAVs) are required to be calculated and disclosed to the public. If a mutual fund manager fails to outperform his competitors in few quarters, or the fund falls in the bottom quartile even for a short period, he may witness the pressure of redemptions. Small investors face no such pressure to perform in the short run.

- No Redemption Pressure – Mutual funds must always hold some cash to meet potential redemptions, often during bear markets when it would be best to invest. Small investors can stay fully invested if they choose and can potentially benefit from Market volatility.

To conclude, in a multiple facet world like ours, while institutional investors are bound by certain rules that they must follow at the cost of common sense at times, individual investors who follow certain fundamental rules of value recognition, performance parameters are not subject to the same and hence can continue to make rational choices. It is important for small investors to do their fundamental research on companies and their prospects before they venture into direct equities and clearly it is not for everyone. The simple disciplined mode of investing like Systematic Investment Plan (SIPs) is good enough. With election results round the corner, euphoria might give way to despair and vice versa quickly. Investors must keep a check whether their asset allocation is in place and look for potential alpha generation over the long term to meet their goals.

By-

Siddharth Alok

AVP- Investments