Blog |

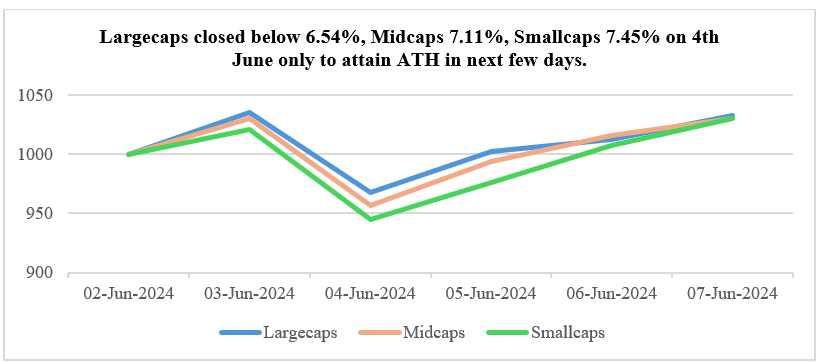

What a month this has been; while General Election results took many by surprise hat the event is marked by extreme volatility proved to be right on the money. Just to give a perspective on 4th June, Nifty-50 saw a fall of ~8% intraday but successfully attained ATH status in next 3 trading sessions. Quite a feat! While many sectors fell between 10 – 15% that day, many sectors are up between 20– 30% in a month’s time.

Now that we are done with elections, what next? Both investors who have made money in this bull run as well as those who missed the bus are in a dilemma whether this will continue, or markets will fall. While we do not have an answer to that, we can surely align our portfolios accordingly & sensibly.

Imagine you are exploring a new city and deciding where to dine after a day of sightseeing. You see two restaurants: one bustling with customers and the other completely empty. Which one would you choose? Most of us would opt for the crowded restaurant, trusting the collective judgment of the crowd to ensure a satisfying meal. This behavior, known as the herd instinct, often serves us well in everyday decisions. However, in the world of investing, following the crowd might not necessarily lead to expected results. The stock market thrives on diverse opinions. When investors make independent decisions based on their own analysis, it leads to efficient price discovery. But when investors follow the herd, this diversity gets lost. Herding in the stock market can lead to unfounded rallies or sell-offs, often creating asset bubbles.

Let us consider the famous Solomon Asch experiment. In this study, participants were asked to match the length of lines on two cards. Unbeknownst to the real participants, the rest of the group were actors instructed to give incorrect answers. Surprisingly, 75% of the real participants conformed to the wrong answer at least once, and 32% always followed the group. This experiment highlights how people tend to go along with the crowd, even when they know itis wrong. In the stock market, this tendency only gets magnified. When faced with uncertainty, investors often look to others for cues, especially from those others appear to be knowledgeable or successful. This behavior is only reinforced by media coverage and the opinions of market experts, who are not immune to herding themselves.

During IT bubble in 2000, the majority believed that nothing could go wrong, and we are entering a new millennium. Before the crash of the subprime bubble, the market’s earnings were growing at 24% YoY over the last 3-4 years. Nothing seemed to be wrong. When the euphoria ebbed, markets corrected by more than 57%from the peak of the IT bubble and 65% from the peak of the subprime bubble. Are we in a bubble right now in some pockets of the market? We can only know we were in the bubble after it bursts.

While it is tempting to follow the crowd, successful investing often requires a contrarian approach—thinking independently and sometimes going against popular opinion. This is easier said than done, as standing apart from the crowd can be psychologically challenging. Our brains react to social exclusion similarly to physical pain, making it difficult to resist the herd instinct. However, contrarian investing can be rewarding. By avoiding the crowd’s mistakes and sticking to a disciplined investment strategy, investors can achieve superior returns.

Building a Support System Investors can improve their decision-making by surrounding themselves with the right team or support system. In the Asch experiment, when just one actor gave the correct answer, the real participant’s likelihood of conforming to the wrong answer dropped significantly. Similarly, having a group of trusted advisors or peers to discuss investment ideas with can help investors maintain an independent perspective. By developing a strong investment philosophy, sticking to it with discipline, and seeking out the right support, investors can navigate the market more successfully. Remember, in investing, it often pays to stand apart from the crowd.

Therefore, should one worry about an impending fall? Certainly not if you are sticking toy our asset allocation. Expensive markets can continue to stay expensive or become more expensive for an exceptionally extended period. But that should not sway you from carefully designed asset allocation suitable to your risk and returns objective. The biggest mistake we as investors can do is not having our portfolio as per the asset allocation plan. Debt in the portfolio reduces the risk and acts as a provision to take advantage of market corrections.

Staying disciplined is the most crucial trait for successful investing. This consistency is key to achieving long-term investment success. Equity markets operate under the principle of mean reversion, but the timing of these reversions is unpredictable. Therefore, adhering to your asset allocation is the only dependable strategy to avoid shocks that could disturb your peace of mind and interrupt your compounding journey. Your ability to maintain discipline with your asset allocation determines your long-term investment success.

By-

Siddharth Alok

AVP- Investments