Blog |

To FD or Not to FD… That is the Question

For decades upon decades the humble FD or a bank Fixed Deposit has been the investment vehicle of choice across India. Even as recently as 2021, despite the variety of investment products availability across the risk returns spectrum (never-mind the super speculative cryptos) , the quantum investments in FDs continue to grow. Imagine this – according to Livemint – India’s GDP in 2021-22 was at ₹147.35 trillion. Compare that to the value of deposits just at the public sector banks across India – a staggering ₹99 trillion Indian rupees.

There is a reason for this undying love of FDs and can be summarized in one word – safety. Or perceived safety anyway.

Are FDs the Safest?

A short answer – NO.

Don’t get us wrong, the FD is sure among the safer products out there – but it is as safe as the bank in which you have opened your FD over Rs 5 Lac (Insured by FDIC?).

There is a saying in the financial markets – “Higher the risks, higher the potential gains” so while a large PSU bank will give you an interest of slightly more than 5% on your FD today if you keep it for one year. A bank, say an XYZ cooperative bank, which is much smaller will give you a higher interest than that. Say 6%, because the chances of the smaller bank, not backed by the government, going bust (think a large private sector bank from a couple of years ago) is much higher than a giant like the large PSU Bank. Hence money in a large PSU Bank FD is “safe” but lets say gives only 5% – the other bank (a smaller/lesser safe bank) will give you higher returns but at a higher risk.

Long story short – an FD is not ironclad and you can lose your money if the bank you have invested in suddenly decides to fold under the pressure from its NPAs or Non-Performing Assets (an article on this coming soon, watch this space!).

So the FD is a product which is safe (relatively), offers a fixed rate of return – which you will get at the end of the deposit period. And may God help you if you decide you need a little extra money and would want to ‘break’ the FD. The charges you will have to bear, the tax impact as well as the number of bank ke chakkar…

What’s the Alternative?

In terms of safety – is there any bank larger than the Reserve Bank of India (RBI – The Central Government’s Bank) itself.

There isn’t. Therefore, there is none safer.

Can a fixed income instrument give returns of more than 6% and be safe? Yes, there is – a guaranteed return which currently is as high as 7.15%! Not just 6% and thereabouts. And guess what, it is linked to the ever-loved NSC Rates and offer 0.35% over NSC rates. Now when the interest rates are going up, this 7.15% could potentially go up further. And as we all know, NSC rates were pretty good even at the bottom of interest rates cycle, aka in 2021.

Will you get your interest at the end of the lock in period. No – the interest is payable half-yearly – so every 6 months you will get that credit in your bank account.

Interested?

Presenting the RBI Floating Rate Bond

RBI has launched Floating Rate Bonds which is a very good alternative to traditional fixed deposit products. The product is suitable for any resident conservative customer who is seeking assured returns from lumpsum investment and wants to preserve the capital invested. The bonds are issued by the Reserve Bank of India (RBI). They are called floating-rate bonds as the interest rate on these bonds is reset every six months starting from January 01, 2021 and is set at a spread of 35 basis points over the prevailing NSC (National Saving Certificate) rate.

Features of Floating Rate Savings Bonds

- Eligibility – Resident Individual (Single/Jointly), HUF

- Entry Age – There is no minimum entry age. In the case of minors, the floating rate bonds can be purchased by parents/legal guardians

- Investments – Minimum INR 1000 – Maximum – no limit

- Interest – 7.15% (interest paid at half-yearly intervals on Jan 01 and July 01 every year. There is no option to pay interest on a cumulative basis). Linked with the prevailing National Saving Certificate (NSC) rate with a spread of (+) 35 bps over the respective NSC rate (6.80%+0.35%)

- Tenure – 7 years

- Exit option – There is no exit option from these bonds before maturity, except for senior citizens

- Suitability – Suitable for conservative investors seeking assured returns from a lump-sum investment

- Taxation – Interest taxed as per the individual income tax slab

The best part is that you do not need a DEMAT account for investing in this bond.

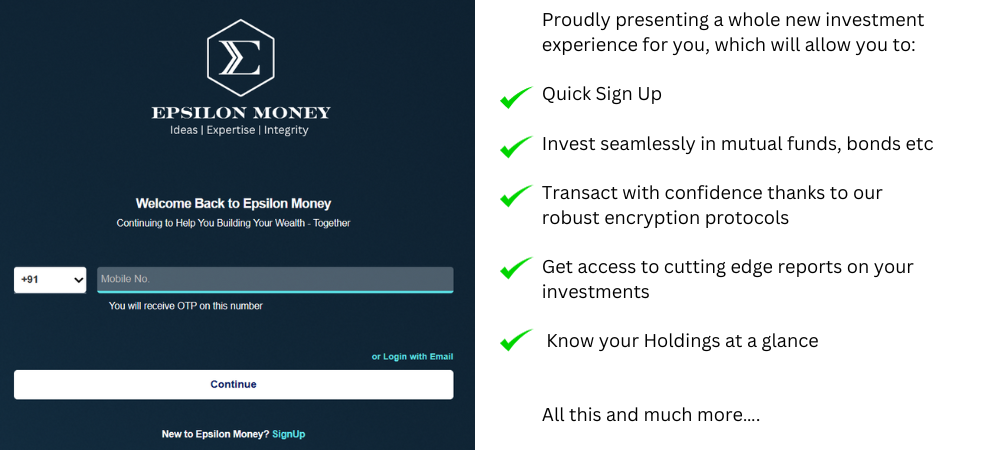

You can invest in the bond through our website Simply click here – enter your PAN and Aadhaar details to get started!

Do get in touch with us in case of any queries – write to us on Info@EpsilonMoney.com