Blog |

When I was tasked with this month’s newsletter, I faced a dilemma. In the last month or so too many things have happened almost in sync around the world. These have led to not only different stock markets behaving differently but at the same time other asset classes like Fixed Income, Commodities & Cryptos (yes, some adventurous investors do treat it as one!) giving diverged returns too. While USA welcomed a new President, India saw the ruling party winning its biggest state by GDP with a large margin. While China continues its struggle & stimulus to stimulate the economy, India’s GDP numbers have taken almost everyone by shock. While USA along with many developed markets are hitting their all-time highs, Indian markets witnessed their worst periodic fall in over 3 years. Let’s discuss on some of them and try analyzing why we are where we are currently; at the same time focusing on things, we can really control.

US Elections

The just concluded US elections was symbolic in nature. Not because both the candidates shared different ideologies and came from pole apart backgrounds but because many think we are in a world where USA is falling. Though history shows us a different picture altogether but still pessimism thrives as we humans like drama and often overlook good news. Evolution has wired us to focus on threats, which skews our perception. This tendency has created a skewed perception of decline, even when the broader picture shows steady, positive progress. Over the last 248 years, the US has shown remarkable resilience and growth. “If you compare our country’s present condition to that existing in 1776, you must rub your eyes in wonder. In my lifetime alone, real per-capita U.S. output has sextupled. My parents could not have dreamed in 1930 of the worlds their son would see.” – Warren Buffett

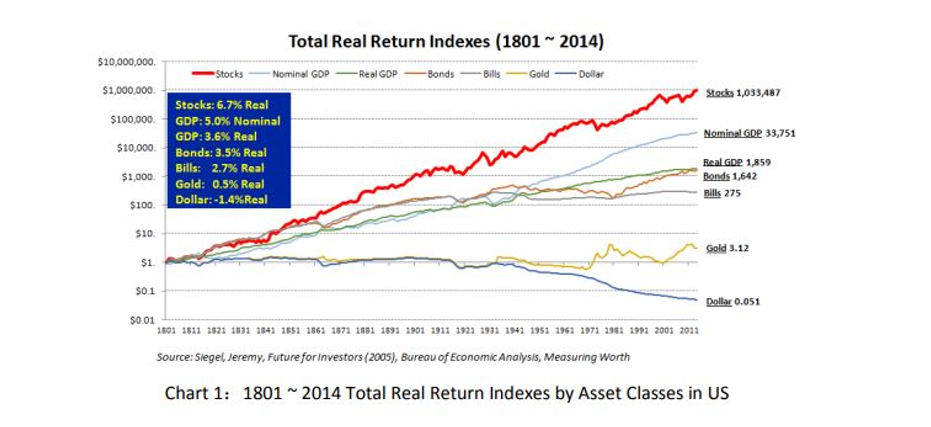

This story of remarkable recovery and progress is not just historical; it remains ongoing, with the US economy showing resilience in the face of adversity. While Europe had Romans, Chinese were equally famous for their trade routes but in the history of mankind, no nation has developed, grown, and innovated like the United States. Despite innumerable civil wars, 2 world wars, political upheavals, corporate scandals, energy crises, and asset bubbles, the list can go on and on, American industry has thrived, and the US equity market has consistently delivered attractive long-term returns. One US dollar invested in stocks 200 years ago, after adjusting for inflation, would now be worth over one million dollars – a testament to the unparalleled returns compared to any other asset class.

This unparalleled growth reflects more than just numbers – it embodies the enduring spirit of innovation and entrepreneurship that defines the American economy. This resilience is rooted in the very system that powers the US economy. The nation’s foundation – free markets, a spirit of entrepreneurship, and an openness to new ideas has been crucial to its success. As the world evolves, new technologies and innovations especially in fields like artificial intelligence, mobility, and analytics are opening even more opportunities for growth. The US, with its deep pools of talent, a culture that encourages risk-taking, and its global reach, is well-positioned to harness these opportunities. This is crucial as well as important not just for US but for all economies, especially ours.

Indian Markets

‘Market has risen too much too soon; a crash is coming. I have sold my entire portfolio.’

‘I am raising 30% cash as the market seems heated.’

‘Valuation seems too expensive so I will not enter the market now & will wait for a correction.’

These are some of the common statements we get to hear from different individuals & clients. Each has their risk appetite & their unique way of dealing with it, but hearing these things triggered certain thoughts in my mind. After an extra-ordinary year where all portfolios have done so well, it is natural to have some anxiety as we enter 2025. I am trying to synthesise the thought process on how one may approach it.

- Indian markets have rebounded well and despite the fall, valuation remain on the higher side – P/E 22.5, P/Bv 3.6. In the long-term, Nifty has mostly traded between 15-25 PE, implying we are currently in the higher band of this range.

- There is indeed an exuberance in the equity markets reflecting in hyperactivity in SMEs, the IPO market, and companies lacking corporate governance. It is wise to stay cautious and alert, but for those who are afraid of a market crash, stay put. If this money is for long-term, which it ideally should have been hence equities, let it compound.

- Valuation is an art and not a science or a maths problem. It is not 2+2 = 4, otherwise any algorithm would have bought at 15 PE & sold 25 PE. It just doesn’t work like that. PE is based on last year’s earnings and projections which may or may not happen. But value over the next 5 – 10 years would be created by quality & multiplication of earnings.

- A lot has changed over the decade, India Inc. has had multiple transformations. As better-quality businesses have occupied larger weights in Nifty, the weighted average valuation has also risen making it further difficult to compare with historical data.

- Just to clarify, we do not encourage BAAP (buy-at-any-price) philosophy, far from it. At no point are we inferring higher PE is good; a lower entry PE would surely lead to a higher margin of safety & better returns, but it is still the earnings growth that will drive most of the value creation/returns in the long run.

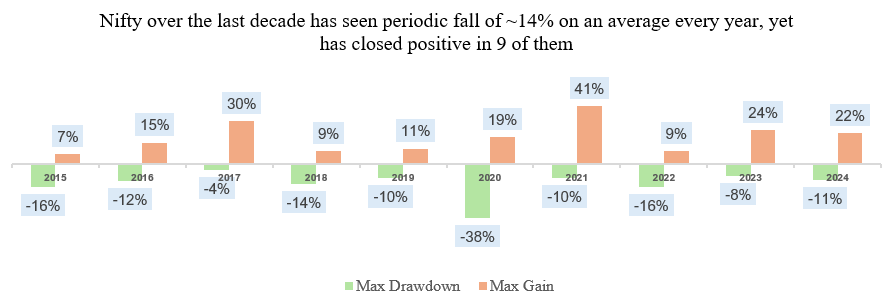

- Now regarding Cash Calls – they tend to work only at scale with extreme outcomes – a hero or a zero. We never know if market will form a bottom at ~10% or at a 25% fall or continue to rise, just like it did after the 2024 Lok Sabha election results. Frequent transactions also involve leakages i.e. taxes, brokerage, impact cost, etc., the result is likely to make the entire exercise meaningless, barring the psychological comfort of holding cash during a market crash. Therefore, while having some handy cash is prudent, waiting for ‘the crash’ to happen is fruitless. In the short term, markets are a voting machine with continues ups & downs.

Always remember even in the darkest times, businesses adapt, innovate, and ultimately generate more wealth than before. 2020 may have proven less fruitful than 2019,and 2025 might face unforeseen challenges. Yet, zoom out, and the picture becomes clearer. With the utmost confidence, 2034 will be better than 2024,just as 2023 far surpassed the dark days of 2013.

Long term investing is not about predicting every market movement or timing every trade perfectly. Instead, it’s about recognising the underlying current of progress and positioning ourselves to ride that wave over decades, not just quarters. It gives us the resilience to weather storms, knowing that calmer, more prosperous seas are beyond the tempest. On the way we will be met with several doldrums but a little faith that the world will grow and a rough sense of which companies are well-run is enough.

To conclude, we investors can learn a lot from Nature, especially in these tough times. Let us take an insightful example from a small bird – a woodpecker.

- Persistence & Precision – A woodpecker typically pecks for 8,000 – 12,000 times a day in search for food or to build homes. Once they find their prey, they leave no stone unturned. Likewise, investors must persist through market turmoil. By focusing on quality companies, one can aim for optimal returns.

- Adaptability– They can live in all climatic conditions by adapting to different environments. Same way, market conditions also change all the time. Staying agile amidst shifts is the key.

- Patience & Timing – In spite of striking all the time throughout the day, these birds go through multiple hours without food. Investors must wait combine patience and discipline.

- Risk Management – Despite trees have hard barks, woodpeckers withstand the impact of their relentless pecking. Investors should learn about position sizing & risk management to weather market storms.

As investors, to achieve long-term financial success, we will endure several hardships. We humans often tend to take decisions emotionally. While equity as an asset class has historically generated decent returns, we tend to extrapolate these gains leading to impatience if market do not (and most often they don’t) move in single – upward direction. To err is human, therefore, despite all the analysis & research things may go wrong – we must have a ready strategy to make required changes that may help us in reaching our financial goals. History shows that a six-sigma event like COVID-19 may occur once a decade, in such a scenario portfolio construction plays the utmost importance. Thus, the crux of Asset Allocation is but learning from the little woodpecker– designing strategic resilient portfolios and being patient.

By-

Siddharth Alok

AVP – Investment